The real estate market has seen lots of ups and downs lately. Nevertheless, the demand for qualified loan signing agents remains steady. These professionals are key in the mortgage and real estate fields. They offer vital services during the closing process. The demand for these professionals as part of the Real Estate process remains significant.

Key Takeaways

- The real estate market has up and downs, however demand for loan signing agents remains steady.

- Loan signing agents provide essential services during the mortgage closing process.

- Skilled and reliable signing agents are in high demand to support the thriving housing market.

- Loan signing agents play a crucial role in the mortgage and real estate industries.

- The role of signing agents is becoming increasingly important amidst fluctuation of the housing market.

What is a Loan Signing Agent?

A loan signing agent is a notary public with a special role in real estate closings. They make sure mortgage agreements, deeds, and other documents are correct and legal. This ensures real estate deals go smoothly.

Role and Responsibilities

Loan signing agents check the identities of the people who sign the documents. Furthermore, they guide them through the signing and witness the legal documents. They need to know a lot about mortgages and real estate to make the closing process go well.

Educational and Legal Requirements

To be a notary signing agent, you need a notary public license. This means finishing a training program and passing an exam. Many states also require extra training in mortgage and real estate to handle the closing process well.

“Loan signing agents play a vital role in the real estate industry, ensuring that the closing process is carried out with the utmost care and attention to detail.”

The Real Estate Market

The real estate market has been fluctuating in recent years. However, many people are still wanting homes and more mortgages are still being taken out. This has made the need for skilled loan signing agents continue to grow as they help homebuyers and homeowners close their deals.

According to Redfin, the United States housing market has seen an increase. “Home prices nationwide were up 4.0% year-over-year in July. At the same time, the number of homes sold rose 6.3% and the number of homes for sale rose 19.2%.”

Given the situation of our housing market, the demand for loan signing agents will still continue to remain strong. Moreover, these agents are key in the closing process, making sure all legal papers are signed and witnessed. In this case, even if the real estate market is fluctuating, people still need efficient and reliable loan signing agents.

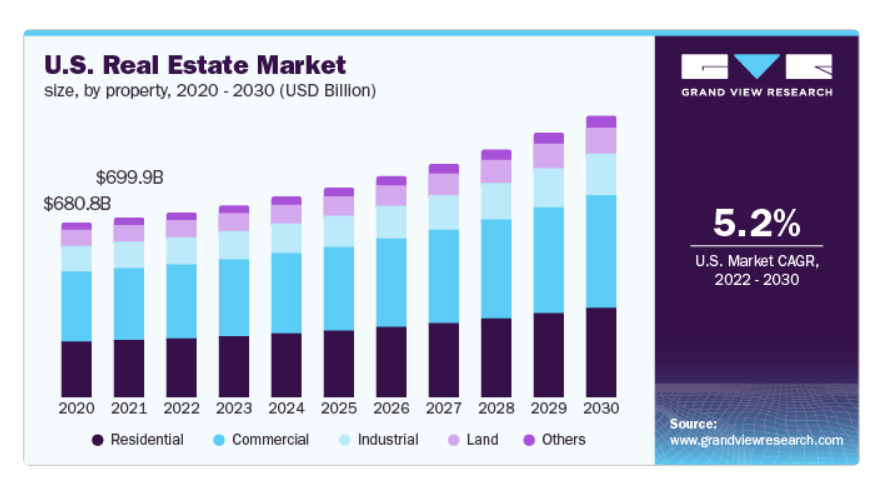

As an illustration, here’s a report overview of the US real estate market as projected by Grand View Research.

Evidently, the market is projected to experience steady growth, fueled by population increases and the demand for personal housing. Hence, this growth presents favorable conditions for loan signing agents to support homebuyers and sellers. Furthermore, the interest rate announced by the Federal Reserve this week may impact the real estate market positively or negatively. It is early to say for sure.

Loan Signing Agents: A Lucrative Career Choice

Becoming a loan signing agent is a great career choice. It offers a flexible schedule and good earning potential. Loan signing agents work for themselves. They can set their own hours and balance work with personal life easily.

Flexible Schedule

One big plus of being a loan signing agent is the flexibility. They don’t have to stick to a strict 9-to-5 job. This lets them work around their personal needs. It’s great for those who need to take care of family or are in school.

Earning Potential

Loan signing agents can make a lot of money. They earn fees for each signing they do. The amount they make depends on the market, how many signings they do, and their experience. Many agents make a good living from their work.

| Metric | Average |

| Hourly Rate | $50 – $125 |

| Annual Income | $40,000 – $150,000 |

The job of a loan signing agent is appealing for those wanting self-employment and financial freedom. It offers both flexibility and good pay.

Skills Required for Loan Signing Agents

To be a great loan signing agent, you need more than just legal knowledge. You must have a keen attention to detail to make sure all paperwork is correct. Also, strong communication abilities are key to guiding signers through the process smoothly. Plus, a deep understanding of legal requirements and top-notch customer service skills are crucial for a smooth client experience.

Loan signing agents are crucial in real estate deals, connecting lenders, borrowers, and title companies. They must be super careful with legal documents like mortgage agreements and deeds of trust. A small mistake can lead to big problems, so paying close attention to every detail is vital.

Good communication skills are a must for loan signing agents. They need to explain documents and procedures clearly, making borrowers feel comfortable. Being a good listener and patient helps build trust and ensures a positive experience.

Loan signing agents also need a strong grasp of legal requirements and real estate laws. They should know the laws well and spot any issues in the paperwork. This knowledge helps them follow the law and complete the signing process correctly.

Lastly, customer service skills are key. Loan signing agents should aim to make the process easy and stress-free for everyone, from first-time buyers to seasoned investors. Patience, empathy, and a desire to help are important traits for building a strong reputation and loyal clients.

“Attention to detail, clear communication, and a deep understanding of legal requirements are the hallmarks of a truly exceptional loan signing agent.”

The Loan Signing Process

The loan signing process is key in real estate deals. A notary public makes sure important documents are signed correctly. As a loan signing agent, you make sure the paperwork is done right and meets legal standards.

Preparation and Paperwork

Before the signing appointment, check the loan signing process paperwork carefully. Make sure it’s all there and correct. This means checking names, looking for mistakes, and putting the documents in order.

- Get to know the loan documents, like the mortgage, deed of trust, and promissory note.

- Make sure all signatures, initials, and dates are in the right spots.

- Have a checklist to help the signers with the paperwork and avoid missing info.

Conducting the Signing Appointment

At the signing appointment, your job is to help the signers understand the loan signing process. You’ll check who they are, watch them sign, and make sure the documents are official.

- Meet the signers and tell them you’re the notary public for the signing appointment.

- Explain each document and why it’s needed, answering any questions they have.

- Watch the signers sign and finish the notarization step as per the law.

Pay close attention to details and know the legal rules of the loan signing process. Being professional and efficient helps make the real estate deal go smoothly for everyone.

Loan Signing Agents: Where to Find Work

Loan signing agents are key in the real estate world, helping with the closing process. They can find many opportunities by working with title companies and using online platforms. These channels offer a lot of chances to grow their careers.

Working with Title Companies

Title companies often need loan signing agents to sign loan documents for their clients. These companies work with experienced agents, offering a steady job source. By partnering with local title companies, agents get a reliable flow of work and make the closing process smooth for everyone.

Good news for all Notary2Pro graduates. We are launching Notary Navigator very soon and this helps our graduates easily find a job. It’s either the employers find you or you find your employer. This is a free platform exclusively for Notary2Pro graduates.

Online Platforms and Marketplaces

Digital tech has brought new ways to connect loan signing agents with clients. Online platforms and marketplaces let agents work independently and choose their projects. This way, they can reach more people and meet the growing need for their services.

| Pros of Working with Title Companies | Pros of Using Online Platforms |

| Established relationships and steady stream of work Reliable payment and administrative support Opportunity to build a strong professional network | Flexible scheduling and work-life balance Ability to market directly to customers Potential for higher earning potential through freelance work |

Loan signing agents can choose to work with title companies or use online platforms. Both paths offer many chances to succeed in this exciting field.

Building a Successful Loan Signing Business

For loan signing agents wanting to grow their business, it’s key to have good marketing strategies and strong professional relationships. A strong online presence, using social media, and networking with real estate agents and mortgage lenders helps. This way, you can build a good name and a solid referral network.

Marketing Strategies

Having a strong marketing strategy is vital to draw in new clients and keep a steady flow of customer relationships. This includes:

- Creating a professional website to show your skills and services

- Using social media to connect with potential clients and increase brand awareness

- Sharing informative content, like blog posts or videos, to be seen as an expert

- Doing targeted email marketing to keep in touch with your network

- Going to industry events, conferences, or local meetings to network and promote your loan signing business

Networking and Referrals

Having a strong network of professional contacts is key for your loan signing business‘s success. By building relationships with real estate agents, mortgage lenders, title companies, and others, you can get a steady flow of referrals and be more visible in the market.

| Networking Strategies | Referral Sources |

| Going to industry events and conferences Joining professional groups or organizations Helping out in the community Talking at local events or workshops | Real estate agents Mortgage lenders Title companies Attorneys and legal professionals Satisfied clients |

By always giving great service and building strong customer relationships, you can use your network to get more referrals. This will help your loan signing business grow over time.

Challenges Faced by Loan Signing Agents

Being a loan signing agent has its ups and downs. They face a complex legal world, needing to follow legal compliance closely. They also have to manage their time well to fit in with clients’ schedules and keep up customer service high.

Time management is a big hurdle for loan signing agents. They often have to handle many appointments at once. They need to be super organized and flexible when things change suddenly.

Keeping up customer service is another big challenge. Agents must be professional and friendly, helping clients through the signing process. This is tough when clients don’t know the legal stuff or feel swamped by the paperwork.

Agents also need to keep up with new legal compliance rules. These can change a lot. They have to learn about new laws and best practices to give their clients the right service.

| Challenge | Description |

| Legal Compliance | Navigating the complex legal and regulatory environment to ensure strict compliance with all applicable laws and guidelines. |

| Scheduling | Effectively managing multiple appointments and adapting to unexpected changes in the schedule. |

| Customer Service | Providing a high level of personalized and professional service to clients throughout the signing process. |

| Time Management | Balancing the demands of multiple clients and ensuring each signing session is completed efficiently and accurately. |

By tackling these challenges and getting better at their jobs, loan signing agents can give top-notch service to their clients. This helps them succeed in this fast-paced field.

The Future of Loan Signing Agents

The real estate and mortgage industries are changing fast, and so is the role of loan signing agents. New tech like e-signatures and remote notarization will change how we sign loans. Also, the strong housing market and more people wanting homes mean loan signing agents will still be in demand.

Technological Advancements

The loan signing agent world is getting a tech boost. E-signatures and remote notarization are becoming more common. This makes signing loans easier and faster for everyone involved. It could also mean loan signing agents can work with clients from anywhere, helping more people.

Industry Trends and Projections

- The housing market is expected to stay strong, keeping the need for loan signing agents high.

- The mortgage industry is set to grow thanks to low-interest rates and more first-time buyers.

- There will be more demand for loan signing agents as the real estate and mortgage sectors change and adapt.

The future looks good for loan signing agents. With new tech and positive trends, there will be more growth and innovation in this field. As things keep changing, loan signing agents will be key in making transactions smooth and secure.

Becoming a Loan Signing Agent

If you’re interested in becoming a notary signing agent, start by getting a notary public license and specialized training. This job offers a flexible schedule and can be quite profitable. It’s perfect for those wanting to start their own business or join the real estate industry.

Training and Certification

To become a certified signing agent, you need to finish a detailed training program. These programs teach you about mortgage and real estate laws. Many schools and professional groups offer these courses.

Students learn how to prepare documents, sign them correctly, and provide great customer service. They also understand legal and regulatory rules. This helps them do their job as a notary public well.

Getting Started

After getting your notary public license and completing training and certification, you can start as a loan signing agent. You can either start your own business or work for companies like title firms or real estate agencies.

Successful signing agents use their networks and marketing to grow their client base. They also keep up with industry trends and technology. This helps them keep their notary business successful.

Conclusion

The need for skilled loan signing agents is growing fast, despite the fluctuating real estate market. They are key in the mortgage and real estate fields. This career is both rewarding and flexible for those with the right skills and who can handle the legal and regulatory parts of the job.

Given the industry’s situation, there’s always a need for trustworthy loan signing services. Signing agents are crucial in making real estate deals happen. They make sure mortgage documents are correct and legal, helping both lenders and borrowers.

If you’re thinking about starting a loan signing business or changing careers, this article offers useful advice. Improve your skills, make connections in the industry, and keep up with new trends. This way, you can succeed in the growing real estate market.

FAQ

To be a Loan Signing Agent, you need a notary public license and training in mortgage and real estate. This training is key.

To be good at this job, you need to pay attention to details. You should be clear in communication, know the law well, and provide great customer service. These skills make the signing process smooth for clients.

First, the agent reviews and prepares all the paperwork. Then, during the signing, they explain the documents to the signers. They check the signers’ identities and watch them sign.

Loan Signing Agents can find work in several places. Many work with title companies. There are also online platforms and marketplaces that connect them with clients.

The future looks good for Loan Signing Agents. With new tech like e-signatures and remote notarization, the job will change. The housing market’s strength and more people wanting homes mean there will always be a need for skilled Loan Signing Agents.

First, get a notary public license and training in mortgage and real estate. Many programs and courses are available to help you. After getting certified, you can start your own business or work with companies in the real estate field.